Accrual Method

There are two main methods of accounting (or bookkeeping):

- Accrual method

- Cash method

The accrual method of accounting is the preferred method because it provides:

- a more complete reporting of the company's assets, liabilities, and stockholders' equity at the end of an accounting period, and

- a more realistic reporting of a company's revenues, expenses, and net income for a specific time interval such as a month, quarter or year.

As a result, US GAAP requires most corporations to use the accrual method of accounting.

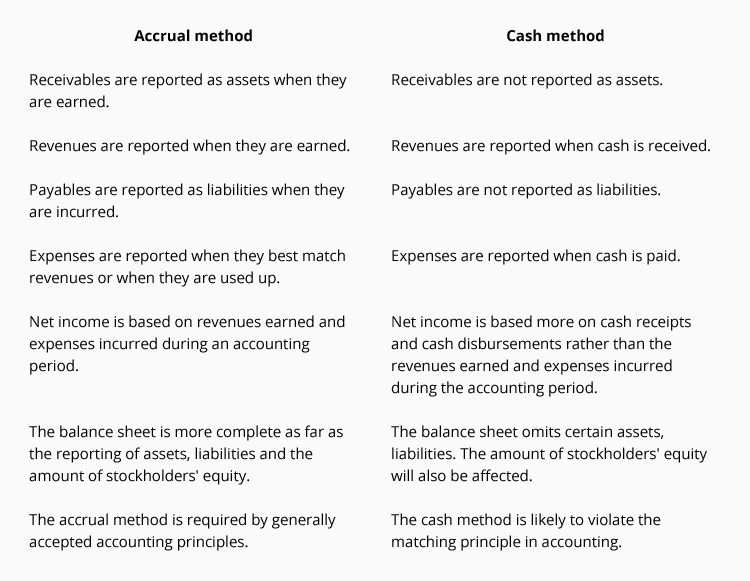

The following table compares the accrual and cash methods of accounting:

Note: Some small companies may be allowed to use the cash method of accounting and in turn may experience an income tax benefit. Since our website does not provide income tax information, you should seek tax advice from a tax professional or from IRS.gov.

Revenues and Receivables

Under the accrual method, revenues are to be reported in the accounting period in which they are earned (which may be different from the period in which the money is received).

To illustrate the reporting of revenues under the accrual method, let's assume that the hypothetical business Servco provides a service to a customer on December 27. Servco prepares a sales invoice for the agreed upon amount of $1,000. The invoice is dated December 27 and states that the amount is due in 30 days.

Under the accrual method, on December 27 Servco:

- has earned revenue of $1,000, and

- has earned a receivable of $1,000.

If Servco uses accounting software to prepare the invoice, the following will be recorded automatically as of December 27:

- the income statement account Service Revenues will be increased by $1,000, and

- the asset Accounts Receivable will be increased by $1,000

In addition to updating the general ledger accounts (which are used in preparing the financial statements), the software will update and store the customer's information for generating an aging of accounts receivable and a statement of each customer's activity.

Expenses and Payables

Under the accrual method, expenses should be reported on the income statement in the period in which they best match with the revenues. If a cause and effect relationship is not obvious, the expense should be reported on the income statement when the cost is used up or expires. In any event, the payment of cash is not the primary factor for determining the accounting period in which an expense is reported on the income statement.

To illustrate, let's assume that Servco uses a temporary help agency at a cost of $200 in order to assist in earning revenues on December 27. The invoice from the temp agency is received on December 27, but it will not be paid until January 4.

Under the accrual method, on December 27 Servco:

- has incurred an expense of $200, and

- has incurred a liability of $200.

If accounting software is used to record the temp agency invoice, the following will occur automatically as of December 27:

- the income statement account Temporary Help Expense will be increased by $200, and

- the liability Accounts Payable will be increased by $200.

When Servco issues its check on January 4:

- the asset Cash will be decreased by $200, and

- the liability Accounts Payable will be decreased by $200.

Net Income

If Servco had only the two transactions described above, its net income under the accrual method for the day of December 27 will consist of the following:

- Earned revenue of $1,000

- Incurred an expense of $200

- Earned a net income of $800 ($1,000 of revenues minus $200 of expenses).[The cash method of accounting would have reported a much different picture:

- No revenue, expense or net income would have been reported on the December income statement.

- The revenues of $1,000 might be reported in February if the customer paid in 35 days.

- The expense of $200 will be reported in January when Servco pays the temp agency.]

Obviously, the accrual method does a better job of reporting what occurred on December 27, the date that Servco actually provided the services and incurred the expense.

No comments:

Post a Comment